34+ How much can i loan for a mortgage

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. Ad Dont Wait Take Advantage of Todays Historically Low Rates While You Still Can.

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Fill in the entry fields and click on the View Report button to see a.

. Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. 51 Adjustable-Rate Mortgage Rates. The cost to refinance a 500000 loan will be.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Total income before taxes for you and your household members. If I pay 34 per month how much of a mortgage loan will that be.

Typically the higher your deposit the lower your LTV. With 1 in 5 Americans owing student debt loan forgiveness can help ease the pain of soaring inflation and economic uncertainty. Of course this value might vary slightly.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. The current average interest rate on a 51 ARM is 450. Save Time Money.

If you lock in. Longer terms usually have higher rates but lower. In Singapore the LTV limit depends on your home type and the number of outstanding mortgages.

Payments you make for loans or other debt but not living expenses like. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Find A Lender That Offers Great Service.

If you factor in a 20 down payment that leaves you with a total purchasing budget. With a total monthly payment of 500 every month for a loan term of 20 years and an interest rate of 4 you can get a mortgage worth 72553. It can be used for any loan such as a home car business.

How Much Mortgage Can I Afford With A Joint Income Of 50k With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below. Easy Online Home Loan Mortgage Application. The average 30-year fixed-refinance rate is 585 percent up 9 basis points compared with a week ago.

You Could be Saving Hundreds by Refinancing Your Mortgage. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Compare Best Mortgage Lenders 2022.

Ad Get Instantly Matched With Your Ideal Home Mortgage Loan Lender. A mortgage loan term is the maximum length of time you have to repay the loan. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act.

This mortgage calculator will show how much you can afford. If you were to take on a 200000. Provide details to calculate your affordability.

Or Refinance to Take Cash Out. 2 days agoHow do mortgage points work. The maximum amount you can borrow with an FHA-insured.

The 52-week low was 409 compared to a 52-week high of 450. Typically mortgage lenders want the borrower to put 20 or more as a down payment. Current 30 year mortgage refinance rate goes up 009.

If the borrowers make a down payment of less. Apply Online Get Pre-Approved Today. Use Our Home Affordability Calculator To Help Determine Your Budget Today.

Using the typical range of 2 to 6 percent of the loan amount closing costs for a 250000 loan will range from 5000 to 15000. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford.

The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. So if you make 100000 a year you can afford to take out a mortgage loan worth 300000. Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best.

Adding up to about 34 billion in total student. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. In some cases borrowers may put down as low as 3.

Ad Compare Current Mortgage Rates Today Save On Your Mortgage Loan - Apply Now To Lock In. The calculator will tell you how much the loan amount will be. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

To be eligible the lender. Common mortgage terms are 30-year or 15-year. Compare More Than Just Rates.

One mortgage point will typically cost 1 of your loan amount and lower your interest rate by about 025. Medium Credit the lesser of. The first step in buying a house is determining your budget.

The interest rate is 26 and you and the amount can either be up to 90 of the propertys price or depending on the assessment whichever is lower. Arizona Mortgage Banker License 0911088.

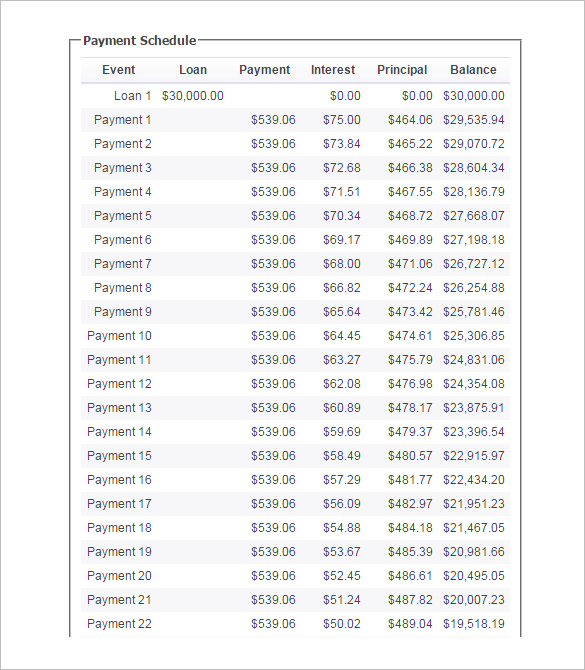

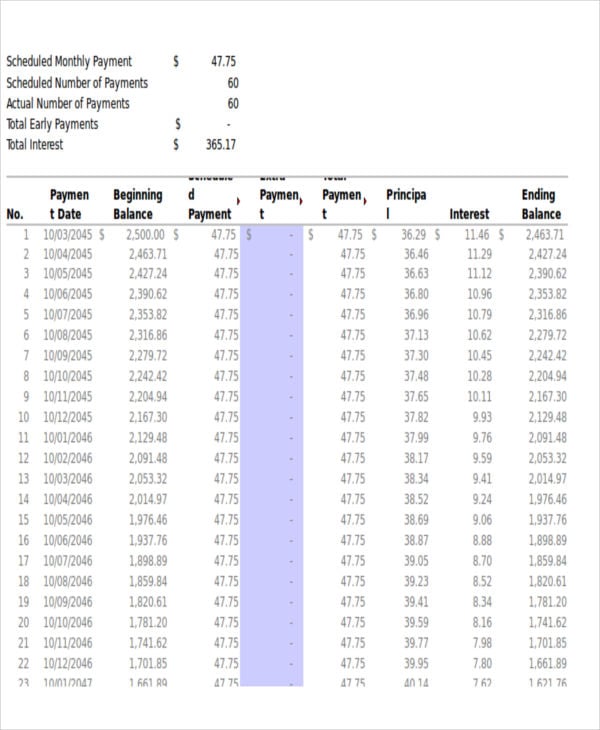

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

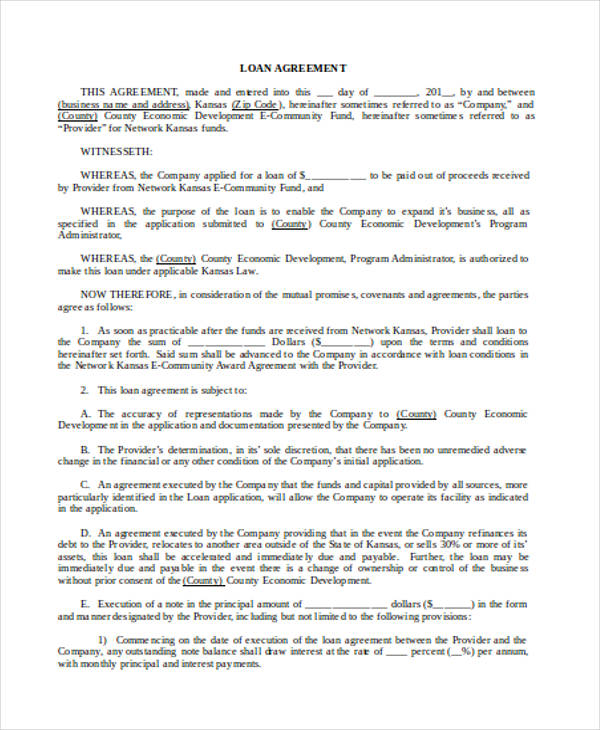

Free 34 Loan Agreement Forms In Pdf Ms Word

Free 5 Personal Loan Agreement Forms In Ms Word Pdf

Promissory Note Template Free Pdf Promissory Note Notes Template Templates Printable Free

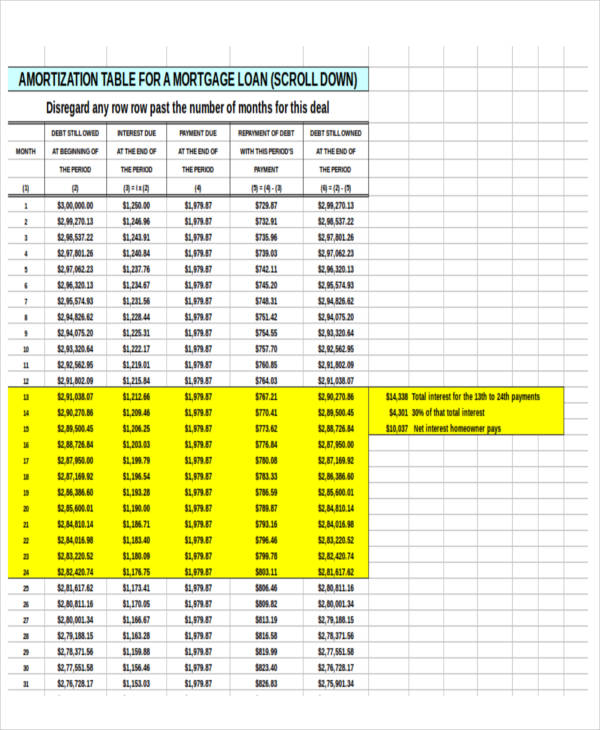

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Free Promissory Note Templates Google Search Promissory Note Notes Template Real Estate Forms

Free 34 Loan Agreement Forms In Pdf Ms Word

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

Free 34 Loan Agreement Forms In Pdf Ms Word

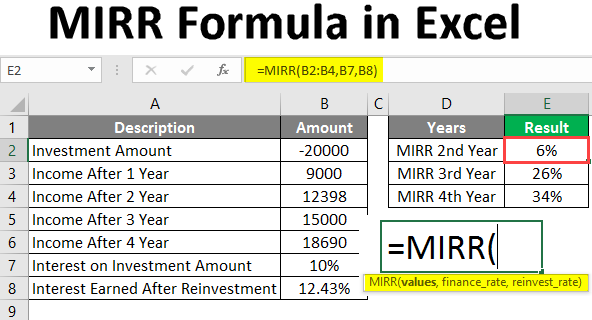

Mirr Formula In Excel How To Use Mirr Function With Examples

Free Promissory Note Form Printable Real Estate Forms Real Estate Forms Promissory Note Notes Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Pin On Projects To Try